Performance

Notice

This is the first draft of the performance section. It will be updated as we progress through the development and refining the model

Optimization Approach

Monorail takes a fundamentally different approach to routing compared to traditional aggregators:

- Analyzes complete liquidity landscape mathematically

- Finds optimal execution path

- Minimizes unnecessary trade splits

- Reduces gas costs and fees

Initial Testnet Results

Monorail's latest v4 model (July 2025) has shown impressive results so far

- 99.2% of executed quotes resulted in the exact amount quoted or higher

- An average standard deviation of 0.34% across the most recent 100 000 trades

We believe this shows that Monorail's Synthetic Orderbooks are a reliable and efficient routing solution.

Real-World Comparison

Consider this real-life comparison with a leading aggregator:

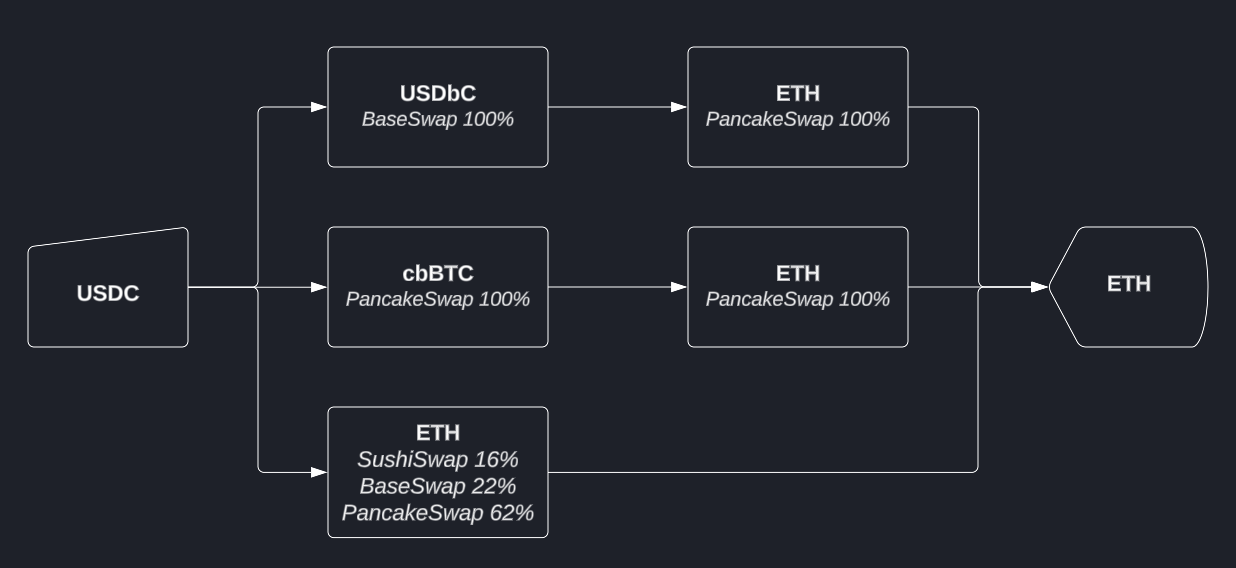

Other aggregator Route (5 swaps)

Other aggregator route

- Input: 5,000 USDC

- Output: 1.52732 ETH

- Complexity: 5 separate swaps

- Multiple token hops

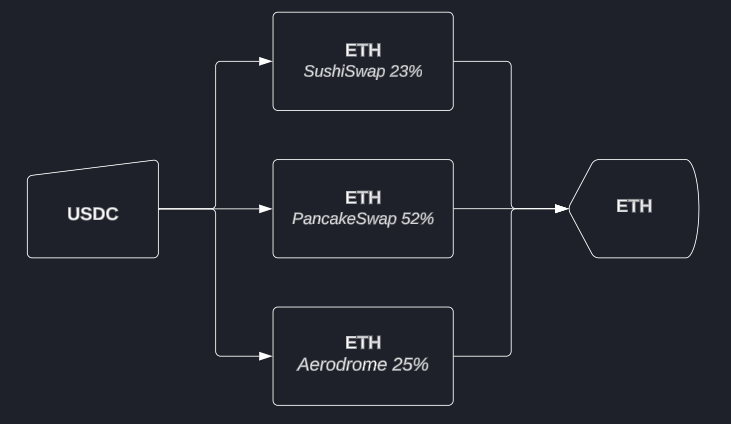

Monorail Route (3 swaps)

Monorail route

- Input: 5,000 USDC

- Output: 1.52769 ETH

- Improvement: +0.00037 ETH

- Reduced complexity: Only 3 swaps

- Lower gas requirements

- Reduced fees

Future Potential

This example focused purely on AMM aggregation. Greater performance advantages are expected once Monad's on-chain orderbooks launch and attract liquidity.